Crypto Property Protection Resources

Learn the ABC’s of Agriculture, Blockchain and Cryptocurrency !!

This new book explores blockchain technology and cryptocurrency’s revolutionary financial framework. The book begins by explaining blockchain’s core concepts and operational mechanisms. Next, we examine the regulatory landscape, historical developments and driving forces behind this evolution. Then, we analyze opportunities in agriculture, regional risk assessment, and blockchain implementation strategies to maximize your land’s potential in this expanding financial ecosystem. Finally, we conclude with strategic estate planning guidance for safeguarding both your digital assets and physical properties like land holdings.

The Purpose of Blockchain and Cryptocurrency.

Cryptocurrencies are property. The IRS classifies digital assets as property. Categorizing digital assets in this way means that every sale, trade, or purchase using cryptocurrency is potentially taxable, and capital gains tax rates apply.

Crypto regulations vary across the U.S. from state to state and even between federal agencies, which all have different ways of defining crypto that come with their own tax implications and laws. Investors should conduct their individual research to determine what crypto laws exist in their respective states.

Think of blockchain like an open book that keeps a record of all past financial transactions made by cryptocurrency holders. Every person’s coin purchase, sale, or cryptocurrency conversion, or coin swap is recorded on the blockchain. The trade gets written down in the book and that page is stapled shut so no one can change it. This page is called a "block." When a cryptocurrency (crypto) holder wants to buy or sell crypto, a block is added on the blockchain recording the transaction for all the world to see, each new block creates a chain. Think of it as if your checkbook was a public document, after every check is written, it is locked but publicly recorded. However, your name, address or personal information is not disclosed, it is all encrypted with numbers and alphabets. Crypto currency that is traded on the blockchain. It is money saved on the internet that can be spent like cash money with the use of a debit card. Crypto can also be converted into dollars and deposited in your bank account. Crypto is often purchased on platforms like Robinhood or Fidelity. This is like purchasing stock on an internet site because crypto can be bought and sold on these exchanges or platforms. Some of these platforms include Coinbase, Crypto.com, and Kucoin. All of these platforms offer debt cards like a bank.

Best U.S. States for Crypto

Wyoming

Florida

Texas

Colorado

Most Challenging States

New York

California

Hawaii

Internal Revenue Service Definition

Cryptocurrencies are property. The IRS classifies digital assets as property.

Jerome Powell, U.S. Fed Chair discusses at a Feb. 2025 meeting how banks can manage cryptocurrency.

FedNow is an instant payment service developed and operated by the Federal Reserve System in the United States. Stablecoins like Tether are backed by US Treasury making it less volatile than coins like Meme coins. Launched in 2023, it enables financial institutions to provide their customers with the ability to send and receive payments instantly, 24 hours a day, 365 days a year. As of early 2025, over 1,200 banks and credit unions are part of the FedNow network, with participants in all 50 states. Allows U.S. banks to handle cryptocurrency transactions at a maximum of $100,000 with a transfer limit of $500,000.

Resource: ABA Banking Journal (Feb., 6, 2025)

What is Fed Now?

What Are the Laws Saying

“To provide services related to crypto in Alaska, you need an appropriate business license from the NMLS and a safety bond with a value of at least $25,000.”

“While many countries are exploring Central Bank Digital Currencies (CBDCs), Wyoming's approach is distinct as it involves a state-issued stablecoin rather than a federal one.”

“Michigan bill would allow the state's treasurer to invest in crypto from both the general fund and economic stabilization fund with a cap of 10%.”

— MI House Bill 4085

“Meta, the parent company of Facebook, is constructing an $800 million data center spanning some 700,000 square feet in Rosemount, MN suburb of Minnepolis”

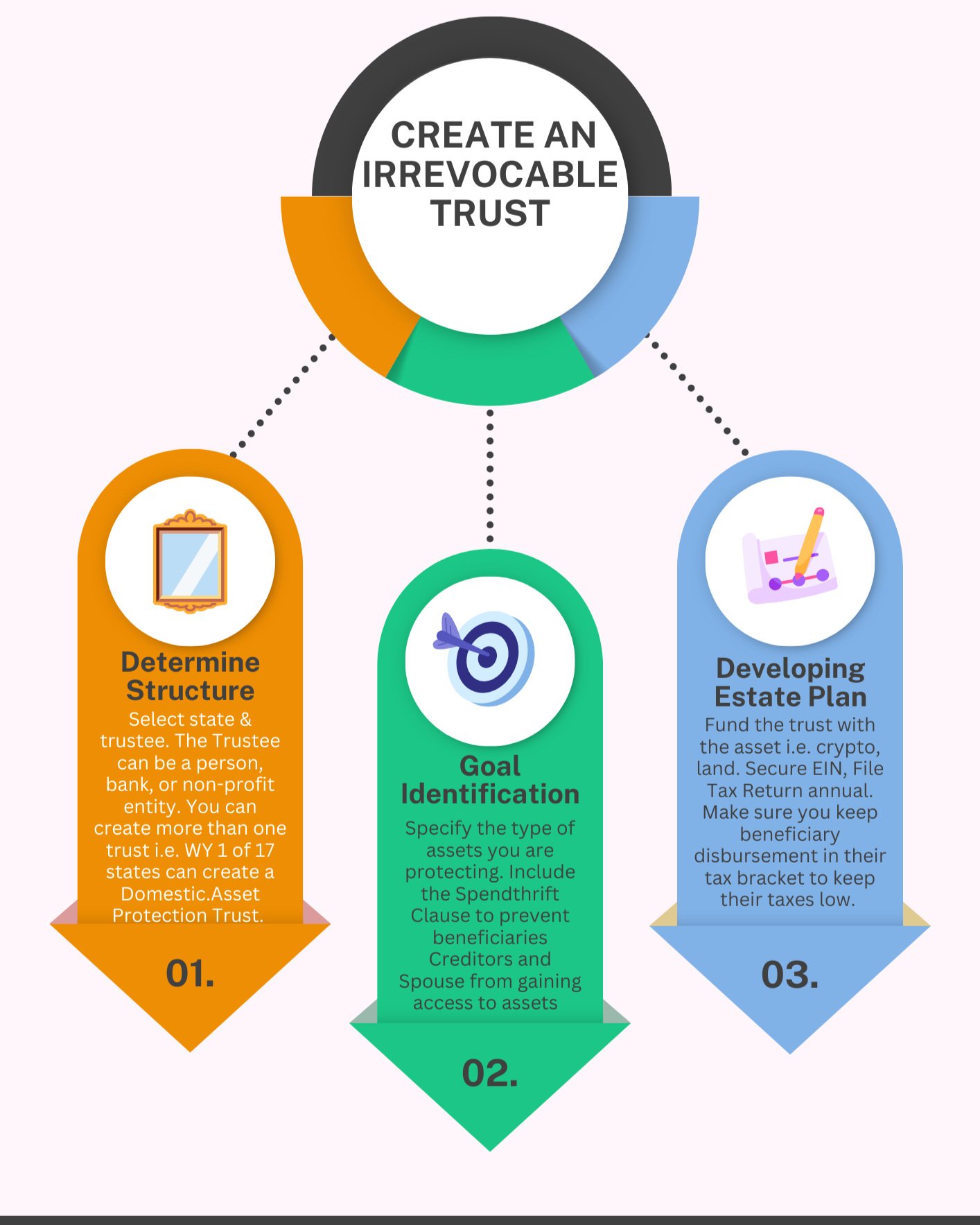

Insurance Policies + Trust

When putting your house into an irrevocable trust, you must ensure the insurance policy lists the trust as the policyholder. For a revocable trust, keep the policy in your own name, but add the trust as an additional insured party. Having mismatched names can create problems when trying to collect insurance payments.